Top 10 Expense Management software

August 04, 2025 | Editor: Michael Stromann

16

Spend management software that automates the creation of the expense report for employees, provides online review and approval process for managers.

1

SAP Concur's easy-to-use business travel and expense management software solution helps your business save time, money and gain control. The Concur booking tool makes business travel a snap—starting with customized options that align with your company policies. You can also upload electronic folios, directly to expense reports. Concur provides full visibility into spend and the ability to ensure policy and regulatory compliance.

2

Simplified expense reporting your employees will love. Streamline the way your employees report expenses, the way expenses are approved, and the way you export that information to your accounting package.

3

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, procurement, and employee expenses to run your business more efficiently and drive growth.

4

Bill.com brings smart AP and AR automation and new bill payment capabilities to your business. The intelligent way to create and pay bills, send invoices, and get paid.

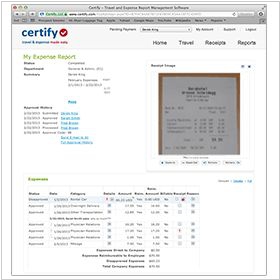

5

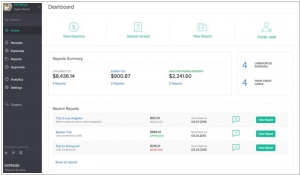

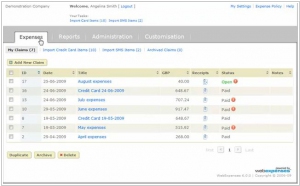

Certify is the leading cloud-based travel and expense report management solution for companies of all sizes. Certify makes expense reports easy by automating the creation of the expense report for the employee, providing online review and approval process for managers, and streamlining the processing and reimbursement process for accountants.

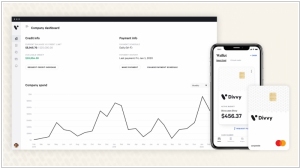

6

Expense Management & Business Budgeting Software. Simplify your business' expense reports with Divvy. Submit expense reports, budget, reimburse employees, and manage virtual cards right from Divvy's platform.

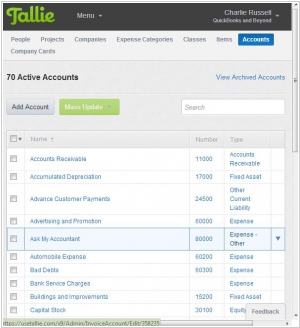

7

Emburse Tallie helps small businesses focus more on work with impact—and less on paperwork for managing expenses.

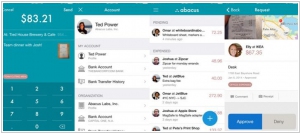

8

Real Time Expense Reporting. Abacus is the easiest way for you to automate how you reimburse your team, reconcile corporate credit cards, and implement your expense policy.

9

Expense reporting doesn't have to be painful. Zoho Expense is a perk for employees, managers, and finance teams. Automate travel and business expense reporting, streamline approvals, gain spend visibility and control.

10

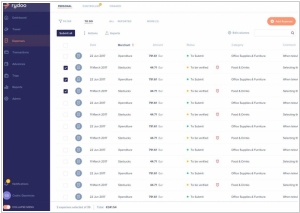

Rydoo is an all-in-one Travel & Expense platform. Book business trips and submit or approve expense claims in real time.

11

Expense management software + AP automation. Automate your expenses, invoice processing + more with our digital business management systems.

12

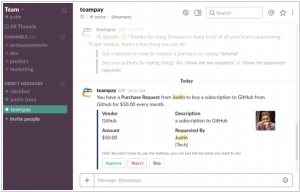

Teampay gives your organization an intuitive workflow and reporting for purchases. This adds security, accountability, and easy approval while giving employees autonomy over their purchasing process.

Important news about Expense Management software

2022. Sava, a spend management platform for African businesses, gets $2M

Sava, the South African fintech that allows small businesses to manage spending, has raised $2 million in pre-seed funding. Sava, which is yet to launch, says it combines bank accounts, mobile wallets, payment and accounting integrations all in one platform. Sava highlights two specific pain points businesses confront around spend management and reconciliations. One, businesses don’t have tools to enable them to control spending. Two, business owners and their teams spend a lot of hours engaging in manual record-keeping and reconciliations and lack sufficient data to lend prudently.

2022. European spend management platform Moss raises $86M

Berlin-based startup Moss has closed a new $86 million Series B funding round (€75 million). The company offers corporate credit cards for small and medium companies so that they can more easily spend and track their spending. Moss could be considered as a spend management platform. It competes with other European players, such as Spendesk, Pleo and Soldo. What sets Moss apart from its competitors is that it offers credit cards, not debit cards. But transactions still show up in your Moss dashboard seconds after each payment.

2021. Pleo picks up $200M to build the next generation of business expense management

Danish startup Pleo, a developer of expense management tools aimed at SMBs to let them issue company cards and better manage how employees spend money, has picked $200 million. Many companies building products like these have mainly focused on large enterprises as customers. (That is changing fast, though: another big player in the same space as Pleo, Soldo, raised $180 million this year, too.) Pleo’s tools today include card issuing, invoice payments and out of pocket expenses, integrating all of this with existing accounting packages to help money management run more smoothly. Pricing starts at a free and limited tier for the smallest customers up to five users, working up to £10 per person per month for bigger customers, as well packages designed for the largest users.